Wells Fargo Direct Deposit

Mobile deposited funds are available on the day after the deposit credit date, unless a hold is applied. If a hold is required on the check, you’ll receive a message during the deposit, and you’ll be able to cancel the deposit. If you continue and submit your mobile deposit, you’ll receive information about the hold on the confirmation screen and in the email sent to your primary email address and secure inbox.

| For deposits made | Funds are generally available |

|---|---|

| Before 9 pm Pacific Time business days | On the next business day after the day of your deposit |

| After 9 pm Pacific Time business days | On the business day after the deposit credit date |

| Non-business days | On the business day after the deposit credit date |

For example, if you make a deposit before the cut-off time on a Monday, funds are generally available on Tuesday. If you make a deposit after the cut-off time on a Friday, funds are typically available on the following Tuesday. Business days are Monday through Friday except Federal holidays. The deposit credit date is provided on your mobile deposit confirmation screen and in the email we send you when your transaction is complete.

Direct Deposit is a free service that automatically deposits recurring income into any Wells Fargo checking, savings, or prepaid card account you choose. Income you receive from your employer, Social Security, pension and retirement plans, the Armed Forces, VA Benefits, and annuity or dividend payments may all qualify for Direct Deposit.

Benefits

The Margin ‘I need my stimmy!’ This is what it feels like waiting for Wells Fargo to deposit your stimulus check Last Updated: Dec. 30, 2020 at 11:51 a.m. ET First Published: Dec. Wells Fargo Asset Management (WFAM) is the trade name for the mutual fund division of Wells Fargo & Co. Mutual funds are offered under the Wells Fargo Advantage Funds brand name. WFAM has $603 billion in assets under management as of December 31, 2020. The Federal Reserve Banks need routing numbers to process Fedwire funds transfers. The ACH network also needs them to process electronic funds transfers – like direct deposits and bill payments. Find Wells Fargo routing numbers for: Wells Fargo checking and savings account routing number; ACH payments routing number; Wire transfers routing number. With Wells Fargo mobile deposit (“Mobile Deposit”) you can make a check deposit directly into your eligible checking or savings account using the Wells Fargo Mobile app on supported Apple ® and Android TM devices. Mobile deposit lets you submit photos of the front and back of your endorsed check. You can save time with fewer trips to a Wells Fargo ATM or branch.

- It's convenient. Free up some time by having your money automatically deposited into your Wells Fargo account.

- It's fast. You have same-day access to your money on the day of deposit.

- It's safe. Never worry about checks getting lost, delayed, or stolen.

Customers with Direct Deposit can also take advantage of our automatic Overdraft Rewind® feature. If we receive an electronic direct deposit by 9:00 a.m. local time, the bank will automatically reevaluate transactions from the previous business day and may reverse overdraft or returned item, non-sufficient funds (NSF) decisions, and waive or refund associated fees.

Three easy steps

If the company or agency that pays you offers Direct Deposit, follow these three easy steps to set up Direct Deposit into your Wells Fargo account.

Step 1. Use our pre-filled form

Sign on to Set Up Direct Deposit to create your customized Direct Deposit form. Simply select the account you’d like your deposits to go to, and we’ll pre-fill the form with your routing number, account number, and account type.

Wells Fargo Direct Deposit Ach

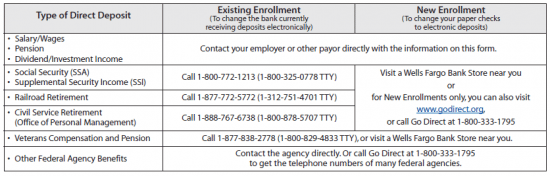

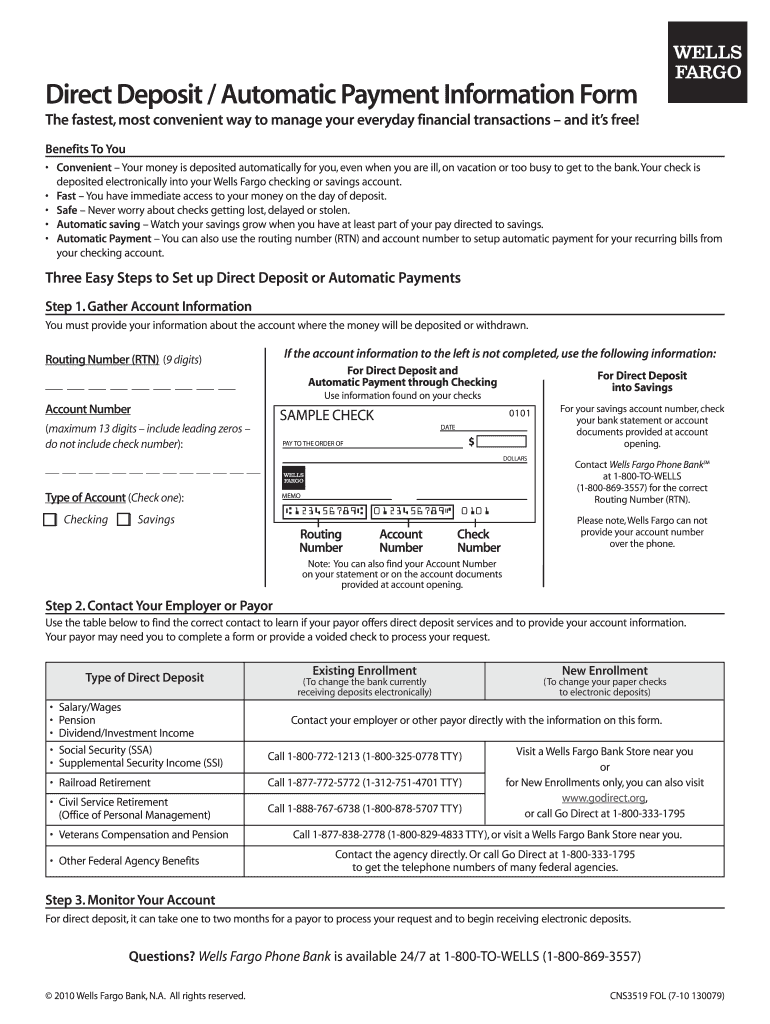

Or you can download a blank Direct Deposit Information Form (PDF) and fill in the information yourself. For accounts with checks, a diagram on the form shows you where you can find the information you’ll need.

If you have questions about direct deposits from a federal agency, you will find full contact information on the Direct Deposit Information Form, or you can visit a Wells Fargo retail banking branch near you.

Step 2. Print your completed form and provide the information to the company or agency that pays you

Your payor may ask you to complete their own form or provide a voided check in order to process your request.

Step 3. Monitor your account

Wells Fargo Direct Deposit Time

It may be one or two pay or benefit periods before Direct Deposit goes into effect. You can sign up for alerts that notify you when a direct deposit is available in your account. Just sign on to set up alerts.

Wells Fargo Direct Deposit Form

Questions?

Wells Fargo Direct Deposit Info

We're available 24 hours a day, 7 days a week at 1-800-TO-WELLS(1-800-869-3557).